-

QR CODES -

PRODUCT FREE

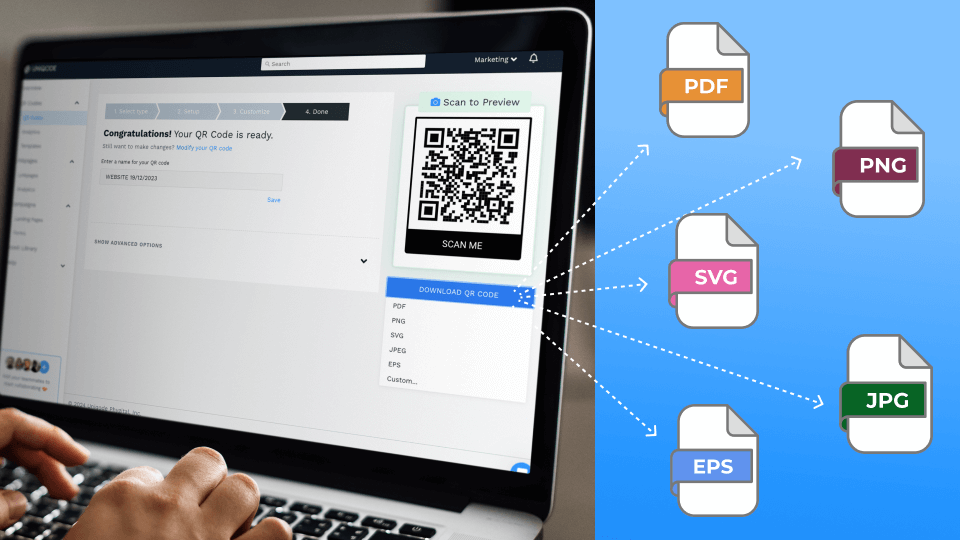

QR Code Generator

Create custom QR Codes for every use case

-

Dynamic QR Code Generator

-

Choosing the Best QR Code Generator

-

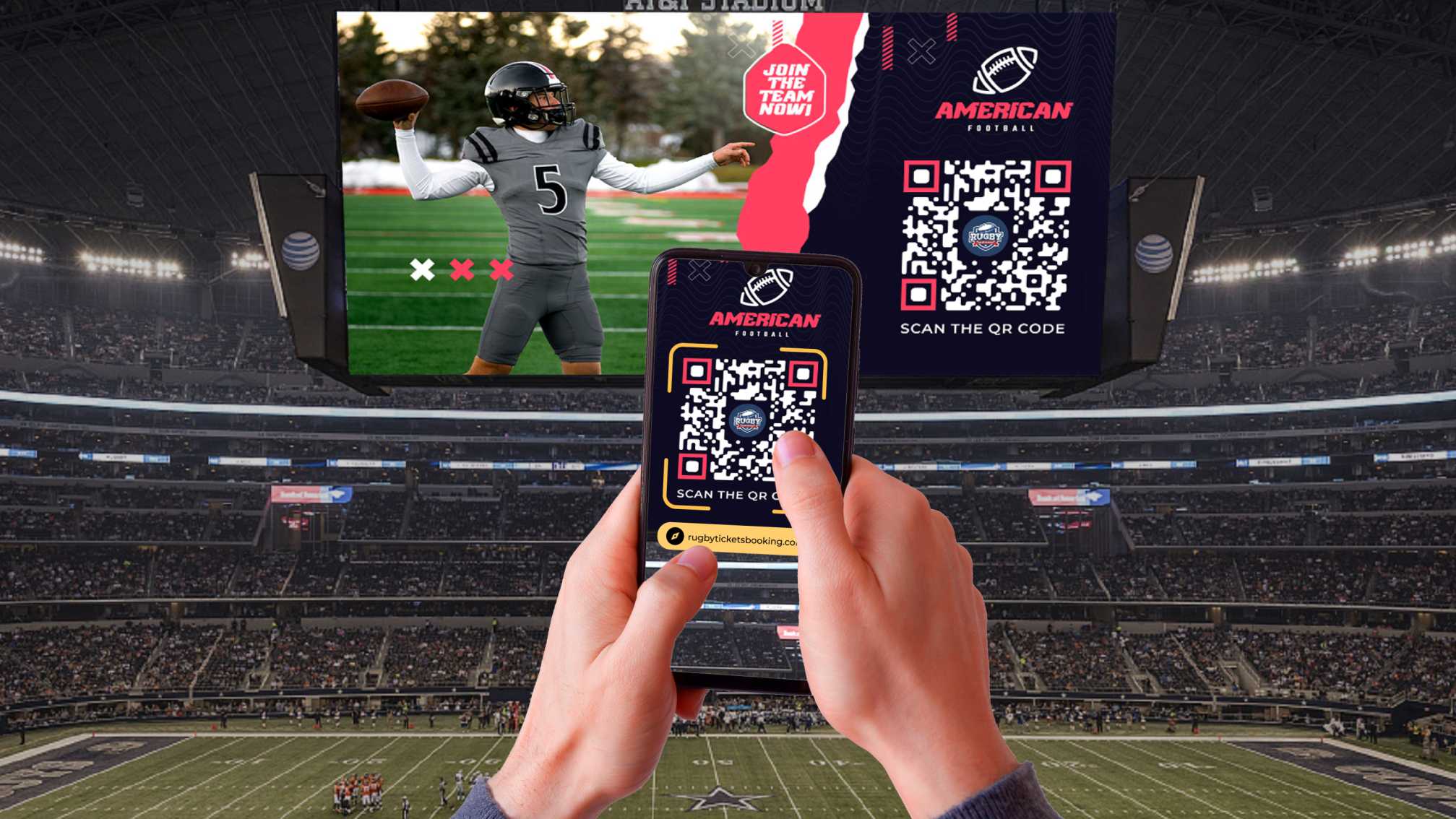

QR Code Tracking

-

QR Code API

-

GET STARTED

Select a template to continue

-

-

DIGITAL BUSINESS CARDS

-

PRODUCT POPULAR

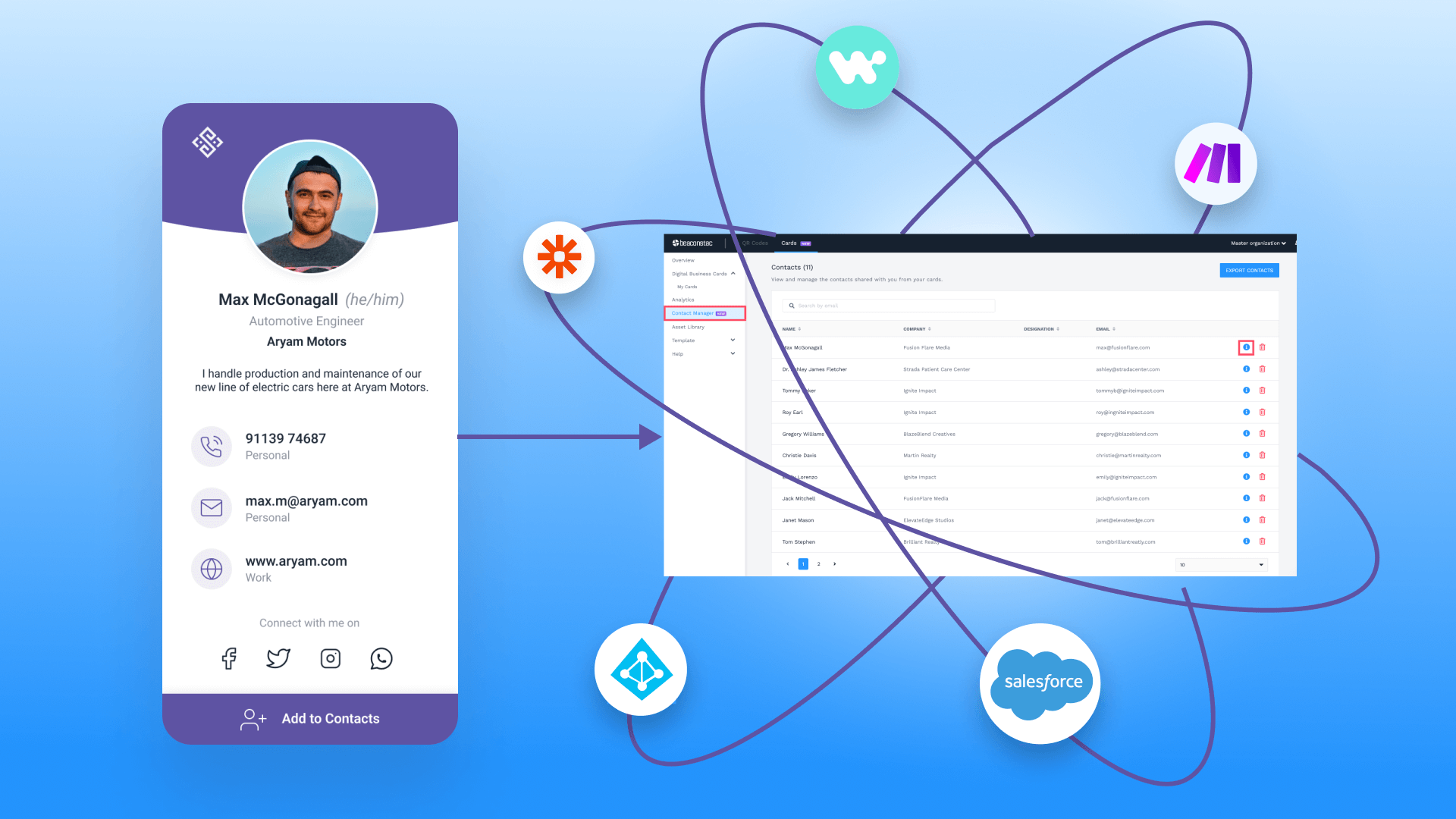

Digital Business Cards

Measure your networking with digital business cards

-

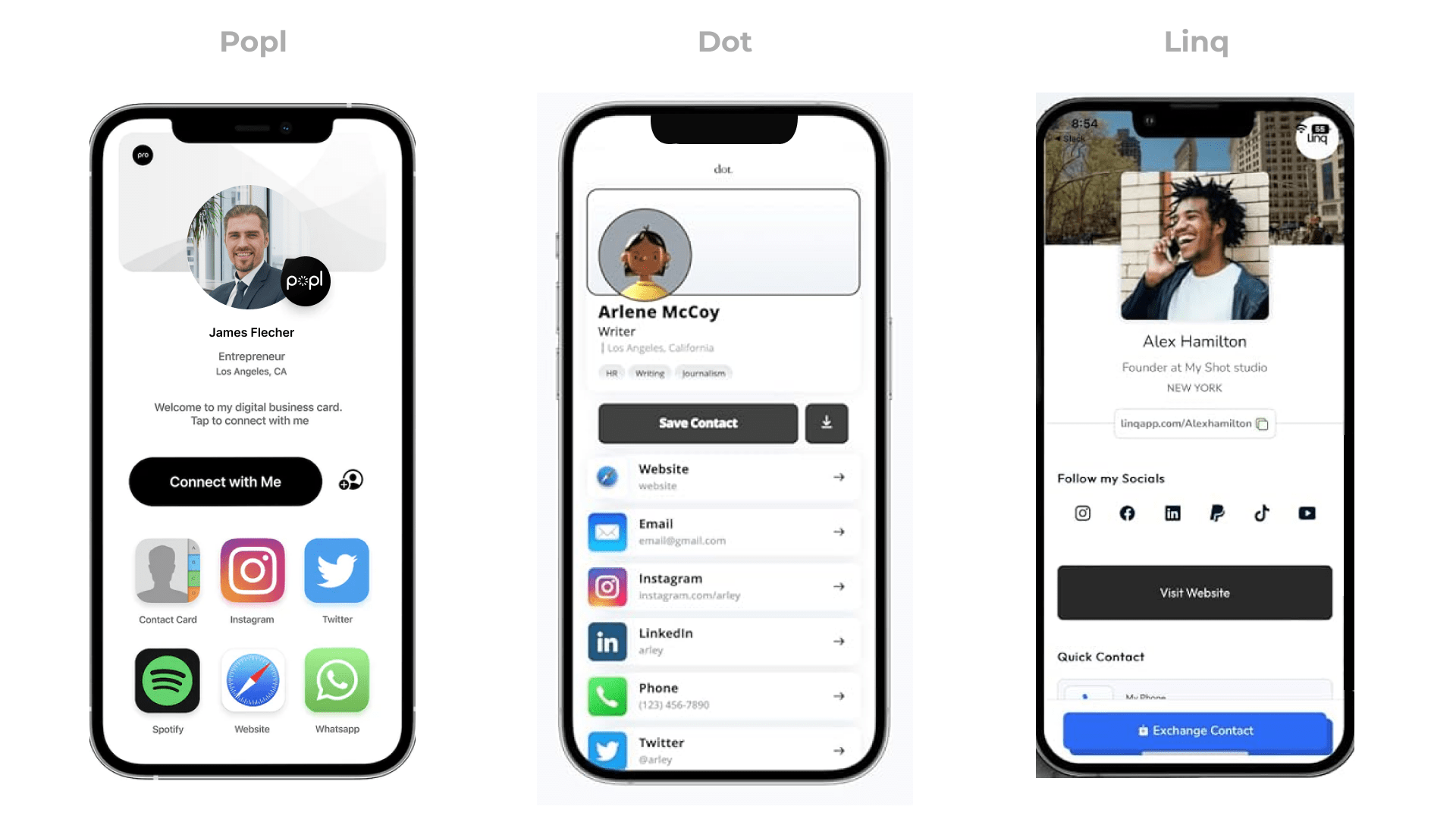

All About Digital Business Cards

-

Apple Wallet Business Cards

-

Physical Vs Digital Business Cards

-

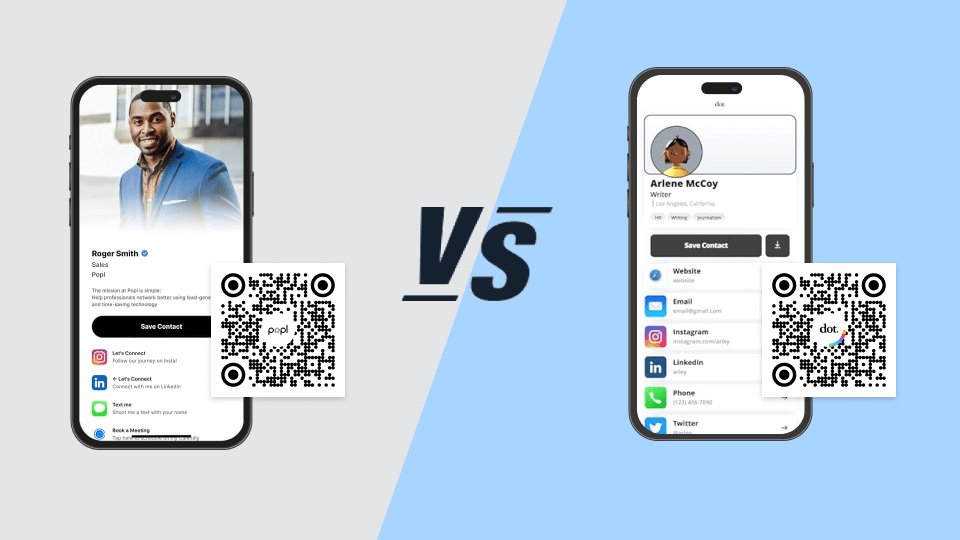

Choosing The Best Digital Business Card Solution

-

GET STARTED

Select a template to continue

-

-

SOLUTIONS

-

LEARN

-

A powerful and easy solution for our business.

Uniqode’s solution has made our lives a lot easier.

MARCELO YANEZ

PRODUCT MANAGER,

NESTLE

Read all customer stories

-

PRICING

-

DEMO